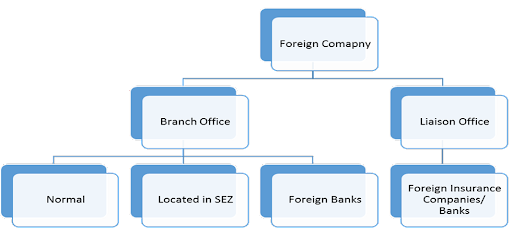

Establishment of Branch/Liaison Office in India by Foreign entities

Every business, as it grows, wants to expand its business globally, for this, it need to establish a subsidiary or branch or liaison office in other country/countries.

It is also required to obtain prior permissions from the respective authorities of other country in which it is willing to operate its business. (Known as Host Country).

India is one of the fastest growing market compare to other countries, and also provides ample opportunities to foreign entities to operate their business from India.

Let’s understand in detail:

- What is Foreign Company, Branch Office/ Liaison Office

- Permitted and Prohibited areas

- Rules and regulations for establishment of branch/liaison offices

- Tax Implications

Meaning of Foreign Company

As per the legislative provisions, a foreign company means –

- company or a body corporate incorporated outside India and

- Which has a place of business

- Whether by itself or through an agent,

- physically or through electronic mode, and Conducts any business activity in India.

Meaning of Branch Office (BO)

- A Branch office is an extension of foreign entity for carrying out the permissible activities in any other country/countries.

- The role of BO is to undertake the permissible activities in India.

Permissible Activities:

- Export / Import of goods.

- Rendering professional or consultancy services

- Carrying out research work, in areas in which the parent company is engaged.

- Promoting technical or financial collaborations between Indian companies and parent or overseas group company.

- Representing the parent company in India and acting as buying / selling agent in India.

- Rendering services in information technology and development of software in India.

- Rendering technical support to the products supplied by parent/group companies.

- Foreign airline / shipping company.

- Normally, the Branch Office should be engaged in the activity in which the parent company is engaged.

Prohibited areas:

- Retail trading activities of any nature is not allowed for a Branch Office in India.

- A Branch Office is not allowed to carry out manufacturing or processing activities in India, directly or indirectly

Meaning of Liaison Office (LO)

- A Liaison office is a representative office of foreign entity which act as a channel of communication between Head Office abroad and parties in India.

- The role of LO is notundertaking any commercial activities but limited to collecting information and providing information about the company to the prospective Indian Customers.

The Permission to set up such offices is initially granted for a period of 3 years and this may be extended from the date of expiry of the original approval/ extension granted by the RBI, if the applicant has complied with the conditions as prescribed by RBI.

Permissible Activities:

- Representing in India the parent company / group companies

- Promoting export / import from / to India.

- Promoting technical/financial collaborations between parent/group companies and companies in India.

- Acting as a communication channel between the parent company and Indian companies.

Note: However, no foreign law firm shall be permitted to open any LO as per recently passed order by the Supreme Court of India.

Compliances for establishment of branch/liaison offices

A body corporate incorporated outside India (including a firm or other associations of individuals), desirous of opening a Liaison office/Branch office have to obtain permission from the RBI under provisions of FEMA 1999.

The application for establishing BO / LO in India should be forwarded by the foreign entity through a designated AD Category – I Bank to the address of – Foreign Exchange Department, Reserve Bank of India.

The application should be forwarded along with prescribed documents which includes –

English version of the Certificate of Incorporation / Registration or Memorandum & Articles of Association attested by Indian Embassy / Notary Public in the Country of Registration.

Latest Audited Balance Sheet of the applicant entity

The applications from such entities in Form FNC (Annex-1) will be considered by Reserve Bank under two routes:

- Reserve Bank Route

- Where principal business of the foreign entity falls under sectors where 100 per cent FDI is permissible.

- Government

- Route

- Where principal business of the foreign entity falls under the sectors where 100

per cent FDI is not permissible.

- Where principal business of the foreign entity falls under the sectors where 100

Note: – Applications from entities falling under this category and those from Non – Government Organizations / Non – Profit Organizations / Government Bodies / Departments are considered by the Reserve Bank in consultation with the Ministry of Finance, GOI.

Criteria which are considered by the RBI while sanctioning Branch office/Liaison Office of foreign entities:

Requirements | For Liaison Office | For Branch Office |

Profit making track record | Immediately 3 FY in the home country. | Immediately 5 FY in the home country. |

Net Worth | >USD 50,000 or its equivalent. | >USD 100,000 or its equivalent. |

The application in Form FNC shall be filed to an Authorized Dealer Category – I along with prescribed documents viz.,

Copy of Certificate of Incorporation/Registration attested by the Notary Public in the country of registration.

AOA/MOA attested by the Notary Public

Audited Balance Sheet

Bankers’ Report from the applicant’s banker in the country of registration showing the number of years the applicant has had banking relations with that bank.

Bankers’ Report from the applicant’s banker in the country of registration showing the number of years the applicant has had banking relations with that bank.

Note: Applicants who do not satisfy the eligibility criteria and are subsidiaries of other companies can submit a Letter of Comfort from their parent company as per Annex-2, subject to the condition that the parent company satisfies the eligibility criteria as prescribed above.

Compliance under Companies Act, 2013

Such foreign companies shall be governed by the provisions of:

(i) Chapter XXII of the Companies Act, 2013

(ii) Companies (Registration of Foreign Companies) Rules, 2014

Rule 3(3) of the Companies (Registration of Foreign Companies) Rules, 2014 requires every foreign to file e-Form FC-1 to the Ministry of Corporate Affairs within 30 days of the establishment of its place of business in India.

And Rule 3(4) provides that in case of any alteration in the aforesaid documents the Foreign Company is require to submit a return in e-Form FC-2 containing the particulars of alteration as per the prescribed format with the Registrar of Companies, within 30 days of any such alteration.

Allotment of UIN Number

The Branch / Liaison offices established with the Reserve Bank’s approval will be allotted a Unique Identification Number (UIN).

The BOs / LOs shall also obtain Permanent Account Number (PAN) from the Income Tax Authorities on setting up the offices in India and report the same in the Annual Activity Certificate (Annex 3).

Note: The Reserve Bank or the Government of India, as the case may be, reserves the right to reject an application for non-fulfilment of any other condition/s not specifically referred above.

Note: The Reserve Bank or the Government of India, as the case may be, also reserves the right to verify / examine the activities of the BO / LO of the foreign entities established in India and to withdraw the permission already granted, after due notice, if the circumstances so warrant or due to changes in the policy.

Skip to content

Skip to content