With the advent of Globalization, more and more Indian companies are interested in doing business outside India. They want to set-up a branch office or a subsidiary abroad. There are multiple benefits of doing so such as cost reduction because they save on import duty, ease of doing business, building an international brand etc.

Overseas investment in wholly owned subsidiaries or joint ventures has been recognized as important avenues for promoting global business by Indian entrepreneurs.

Broadly there are two routes under which one can set up a WOS abroad, namely automatic route and approval route. Under the automatic route, a company does not require any prior approval from the regulatory authority for setting up a WOS abroad.

While other proposals / activities not covered by conditions under automatic route would require prior approval of the Reserve Bank.

Overseas Investment under Automatic Route

Under the Automatic Route, an Indian Party does not require any prior approval from the Reserve Bank for making overseas direct investments in a Wholly Owned Subsidiary (WOS) abroad. The Indian Party should approach an Authorized Dealer Category – I bank for effecting the remittances towards such investments.

“Indian Party” is any or combination of the following:

(It should be noted that individuals are not allowed to invest under the Automatic Route).

An Indian company can make overseas investment in any activity (except those that are specifically prohibited) in which it has experience and expertise. However, for undertaking activities in the financial sector, certain additional conditions specified in Regulation 7 may be adhered to.

Real estate sector and Banking are the prohibited sectors for overseas investment. However, Indian banks operating in India can set up JV/WOS abroad provided they obtain clearance under the Banking Regulation Act 1949.

Only an Indian Company engaged in financial sector activities can make investment in the financial services sector provided it fulfills the following norms:

iii. has obtained approval from the regulatory authorities concerned both in India and abroad for venturing into such financial sector activity;

The criteria for overseas direct investment/ financial commitment under the Automatic Route are as under:

iii. The Indian Party routes all the transactions relating to the investment in a WOS through only one branch of an authorized dealer (bank) to be designated by the Indian Party.

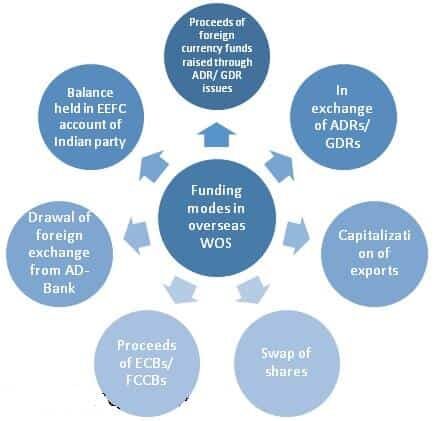

“Financial commitment” means the amount of direct investments outside India by an Indian Party and includes –

iii. 100% of the amount of corporate guarantee issued on behalf of its overseas WOS;

The Indian Party intending to make overseas direct investment under the automatic route is required to fill up form ODIonline through AD bankduly supported by the documents listed therein, i.e., certified copy of the Board Resolution, Statutory Auditors certificate and Valuation report (in case of acquisition of an existing company) as per the valuation norms and approach an Authorized Dealer (designated Authorized Dealer) for making the investment/remittance.

Reserve Bank shall take into account the following factors while considering such applications:

a) Prima facie viability of the WOS outside India;

b) Contribution to external trade and other benefits which will accrue to India through such investment;

c) Financial position and business track record of the Indian Party and the foreign entity; and

d) Expertise and experience of the Indian Party in the same or related line of activity as of the WOS outside India.

With a view to enabling recognized star exporters with a proven track record and a consistently high export performance to reap the benefits of globalization and liberalization, proprietorship concerns and unregistered partnership firms are allowed to set up WOS outside India with the prior approval of the Reserve Bank subject to satisfying certain eligibility criteria.

An application in form ODI may be made to the Chief General Manager, Reserve Bank of India, Foreign Exchange Department, Overseas Investment Division, Central Office, Amar Building, 5th Floor, Fort, Mumbai 400 001, through their bank.

Registered Trusts and Societies engaged in manufacturing / educational / hospital sector are allowed to make investment in the same sector(s) in a WOS outside India, with the prior approval of the Reserve Bank.

Compliances by Indian Party

Where the law of the host country does not mandatorily require auditing of the books of accounts of WOS, the Annual Performance Report (APR) may be submitted by the Indian Party based on the un-audited annual accounts of the WOS provided:

Fill up the form and our team will get back to you in 24 hours.